Econet Telecom Lesotho in partnership with Lesotho National Insurance Group (LNIG) yesterday introduced a new funeral insurance policy in yet another addition to Econet services product offering at the Lesotho Sun Convention Centre.

Ecosure Mpolokeng is an innovative insurance policy specially designed for Econet Telecom Lesotho (ETL)’s prepaid mobile phone customers between the ages of 18 and 65.

It affords would-be subscribers convenient access to a funeral policy through the use of their mobile phones.

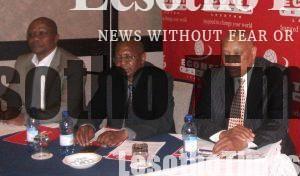

Speaking on behalf of ETL’s CEO, Econet Services manager Thekiso Kuleile said ETL was proud to present Ecosure to the public as the latest product from ETL’s Econet services division.

“Through partnership with LNIG, we have come up with a product that is trendsetting.

“It is a first of its kind and a trend setter for other companies in the industry” he said.

He added that there still remains a large number of people without access to insurance in Lesotho and they hoped that this initiative would enable over 600 000 subscribers that made up ETL’s customer base to be reached.

Describing the specifics of how the product would work, Brand manager ’Makatleho Raphoolo said registration and subscription to Ecosure was an easy, effortless process carried out at the convenience of the customer.

“Ecosure Mpolokeng offers ETL mobile subscribers an insurance policy with ease.

“There are no queues and no added costs of travelling to service centres as monthly premiums are paid using the subscriber’s existing airtime” she said.

“All of this is done from the comfort of one’s home, just by dialing *188#”, Raphoolo added.

A customer seeking a M2 500 benefit would pay M9 as monthly subscription.

For a M5 000 benefit cover, a subscriber would pay M14 per month while a M25 monthly premium would guarantee the policy holder a M10 000 benefit.

Raphoolo further explained that Ecosure was a single-member policy; one policy and one member per cellphone number and that claims would be processed from any ETL service centre in the country.

“In the event of death of the policy holder, their beneficiary will be required to submit the necessary documentation and when a claim has been confirmed, payment will be made to the beneficiary,” said Raphoolo.

Asked how ETL would verify a subscriber’s identity in the event of death and theft of the mobile phone, the brand manager replied that a registered beneficiary would only need to provide the cellphone number and death certificate of the policy holder within 180 days.

Speaking at the same event, LNIG managing director, Ralitapole Letsoela said the launch of Ecosure was the result of a very successful partnership between the two companies.

He commended ETL for breaking new ground and coming up with technological means to make the product possible

and added that LNIG was proud to partner in this pioneering quest that would add value for all.

“This is a simple, affordable, innovative and cutting edge product that will more than delight the market” he said.

On behalf of the Central Bank of Lesotho Mokotjo Mphaka applauded ETL for what he called “an exciting initiative that not only added to the type of financial products available but also served to increase financial inclusion in the country”.

Following the launch, ETL will be embarking on an educational drive countrywide to create awareness on Ecosure and its benefits.

Customers can also inquire further on the toll free number 199.