Moorosi Tsiane

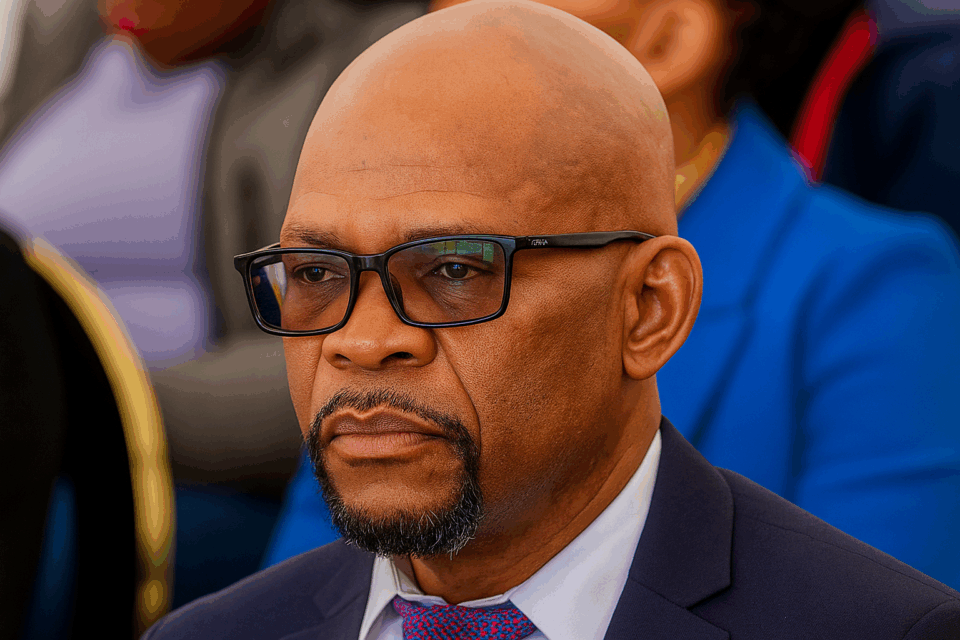

AXED Lesotho Post Bank (LPB) Managing Director, Molefi Leqhaoe, has petitioned the High Court to overturn the government’s decision to fire him, arguing that his dismissal was unlawful and based on untested corruption allegations.

Mr Leqhaoe and the bank’s Chief Sales Manager, ‘Mathabo Tšehlo, who were both dismissed on 27 March 2025, are challenging what they call an “illegal and void” decision to terminate their contracts.

The pair were dismissed following their August 2024 appearance before Maseru Resident Magistrate Thabang Tapole, who charged them with corruption, money laundering and fraud. They were charged alongside Digital Banking Manager, ‘Mamohau Mapota.

Their fraudulent and corrupt scheme prejudiced the government of M10 582 995 and the LPB of M3 235 500, according to the Directorate on Corruption and Economic Offences (DCEO)’s charge sheet.

According to the charge sheet, the government had asked LPB to facilitate loans for Basotho to acquire vehicles for the Basotho Fleet Scheme under which it hired vehicles for use by the State.

The fired LPB executives ran the scheme with the connivance of Ministry of Finance and Development Planning officials who ensured that their relatives were corruptly roped in to provide fleet services to the government from 2021.

The government wanted to use the scheme to empower marginalized entrepreneurs like women and the disabled who have little access to lucrative opportunities.

Mr Leqhaoe, Ms Tšehlo and Ms Mapota were accused of using the scheme as a gravy train for their own cronies for whom they facilitated loans despite not meeting the qualifying criteria.

The LPB’s own policy explicitly stated that employees and their relatives were excluded from the scheme.

That did not stop the trio from allegedly conspiring with their relatives to secure the vehicle loans unlawfully, in the process violating the bank’s policy by failing to disclose their relationships with the loan recipients.

The accused allegedly approved vehicle loans for several individuals closely related to them, including M440 000 for Malerato Tlalinyane, M432 000 for Maletsabisa Seboka, M475 000 for Mamorena Matsoso, and M580 000 for Khethang Makhetha, among others. As a result of these actions, LPB reportedly suffered a financial loss of M3 235 500.

Furthermore, the trio are accused of working in cahoots with finance ministry official, Folojeng Folojeng, who was tasked with facilitating contracts between eligible Basotho and the government.

Former Principal Secretary at the Ministry of Gender and Youth, Sports and Recreation Tjoetsane Seoka, is also charged with corruption for allegedly partaking in corruptly facilitating the contracts.

Mr Seoka ensured that Mr Leqhaoe, Ms Tšehlo and Ms Mapota’s relatives were placed ahead of everyone else in the queue to secure the contracts.

For instance, the LPB’s chief Sales Manager Tšehlo’s son, Thabo, was put in the forefront for a contract.

Messrs Folojeng and Seoka allegedly orchestrated a plan for vehicles to be rented to the government by cronies of the bank executives. The government paid between M19 702 and M21 623 per month per vehicle for the rentals since 2021.

It was prejudiced of up to M10 582 995 in the process.

Thabo (Tšehlo’s son), Tlalinyane, Seboka, Matsoso, Seoka, and Folojeng as well as Mampho Molefi, Jota Hlabana, Ntsebo Thamae, Khethang Makhetha and Keneuoe Mochekoane, who had also received loans and monthly rental fees from the government, are part of the charge over the M10 582 995 prejudice to the state.

Mr Leqhaoe and Ms Tšehlo’s alleged conduct prompted the LPB Board to suspend them on 6 August 2024, and they were later dismissed in March 2025 on the grounds that they were no longer “fit and proper” to hold office, as provided under Sections 43 and 44 of the Financial Institutions Act, 2012.

But the two have refused to take the decision lying down.

They have filed a High Court application seeking a declaration that LPB’s decision be reviewed and set aside as “illegal, null and void, and of no legal force or effect”.

It is not clear whether Ms Mapota was also fired.

The LPB, Central Bank of Lesotho, Minister of Finance and Development Planning, Dr Retšelisitsoe Matlanyane, and Attorney General, Rapelang Motsieloa, are cited as first to fourth respondents.

“I was suspended from duty on 6 August 2024 following criminal charges of alleged corrupt practices currently pending before the Magistrate’s Court of Maseru. My suspension paved the way for a disciplinary hearing scheduled to commence on 18 November 2024,”

Mr Leqhaoe states in his founding affidavit.

He says as the hearing approached, he requested access to all the documents to be used against him to prepare his defence. However, the hearing did not proceed as planned after he fell ill. Some documents were later served on 21 November 2024, and the hearing was rescheduled for 25 November 2024.

“On 25 November 2024, the hearing proceeded before the LPB disciplinary panel. At the outset, I requested to be legally represented due to the complexity of the charges and in the interest of fairness and equality of arms. My request was declined, and I was compelled to proceed unrepresented. Fortunately, after two witnesses had testified, the hearing was postponed to 27 November 2024, allowing me the opportunity to consult my legal representatives.”

He adds that an urgent Labour Court application was launched seeking an order declaring his right to legal representation and compelling the employer to avail all the documents and witness statements — a request that was granted in his favour.

However, he says, LPB, dissatisfied with the Labour Court’s order, invoked the Financial Institutions Act 2012 to declare him unfit to hold office — a move he argues was outside the bank’s powers.

“While the Act sets out the criteria for determining fitness and propriety, it vests such powers exclusively in the Commissioner — that is, the Central Bank — and not the employer.”

Mr Leqhaoe says LPB’s determination was later forwarded to the Central Bank for confirmation, which, “contrary to the clear provisions of the Financial Institutions Act, 2012”, merely reaffirmed the bank’s decision.

“LPB and the Central Bank reached their conclusions based on unproven allegations which had not been tested before any disciplinary body or tribunal established under the Act.”

Following the Central Bank’s reaffirmation, LPB invited the pair to meetings on 3 and 4 February 2025, purportedly to propose alternatives to termination.

“Anticipating that the meeting would culminate in termination, we approached the Labour Court seeking urgent relief to stay the process and to have the decision declaring me unfit and improper set aside. The Labour Court granted an interim order maintaining the status quo… Despite that order, LPB proceeded to terminate my employment on 25 March 2025.”

Mr Leqhaoe says the decision has had far-reaching consequences.

“The net effect of the decision is that I and my co-applicant cannot be employed in any financial institution, and that is a lifetime prejudice.”

While Ms Tšehlo later reached a negotiated settlement with LPB, she too remains declared unfit and improper — a status she is also challenging.

Mr Leqhaoe further claims they have already lodged an appeal against the LPB and the Central Bank’s decision, but their efforts have been met with silence.

“Since lodging the appeal, no tribunal has been constituted to date. On 1 July 2025, we wrote to LPB, the Central Bank, and Dr Matlanyane inquiring whether the tribunal had been established and when our appeal would be heard… predictably, our letter received no response.

“We are now compelled to bring the present application, fully aware that the respondents will likely argue that we have not exhausted domestic remedies.

“However, if domestic remedies are to have any meaning, they must be accessible and effective. It is untenable that the Central Bank should act with such alacrity in reaffirming the adverse decision, yet remain entirely inert in facilitating the constitution of the tribunal to hear our appeal.”

Mr Leqhaoe argues that LPB acted beyond its powers under the Act and failed to observe the rules of natural justice.

“The impugned decisions were taken in blatant disregard of the audi alteram partem principle (ensuring that no one is judged without a fair hearing), a fundamental tenet of administrative justice. As a result, the said decisions are procedurally unfair and must be reviewed and set aside.”