Bereng Mpaki

LESOTHO PostBank (LPB) this week launched the country’s first flexible fixed deposit account that allows clients to withdraw and increase their deposits before maturity of the initial investment.

Named the Fupe Fixed Account, the innovation does not require fixed regular installments but instead allows clients to make a once off deposit or several irregular payments made over a fixed investment period.

The investment periods range from three months to five years while the account has a M1 000 minimum opening deposit and has unlimited maximum deposit.

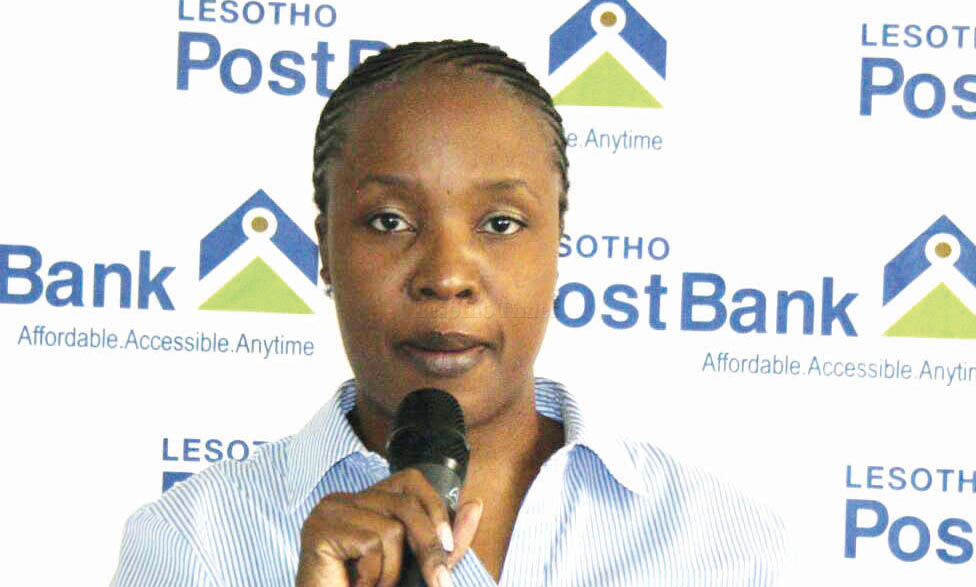

According to LPB’s chief sales officer ‘Mathabo Tšehla, the new product is suitable for clients who may encounter financial emergencies that may require them to access funds invested in their fixed accounts before their investments mature.

She said the account is also suitable for people who may unexpectedly have cash to save and eventually top up their investments at any given time.

“This account makes it easy for customers to access their funds in the middle of their investment and also allows them to increase their investments any time they may have excess money to save,” Ms Tšehla said.

“With this account, there is therefore no chance for defaulting on installment payments because there is no fixed regular payment, a client can choose to make a once off deposit and then make another one when they have some extra money to spare.”

She however, said withdrawing funds from the investment before maturity would lead to a 50 percent reduction of the interest rate that the investment would have accumulated at the end of its maturity.

Asked about the Fupe Account’s interest rates, Ms Tšehla only said they offer competitive market-related interest rates.

“It should be noted however, that the interest rate for a three-month investment will be different from that of a five-year investment.”

Like other commercial banks, LPB has other fixed deposit accounts like Telea, which allows once off deposits and Ngatana, which allows monthly instalments. Both accounts do not allow mid-term withdrawals, and Ngatana lapses in the case of a default in installment payment.

Ms Tšehla also said that the Fupe Account has no banking charges for either deposits or withdrawals.

Depositing funds into the account can be done through cash, stop orders or electronic transfers.