Bereng Mpaki

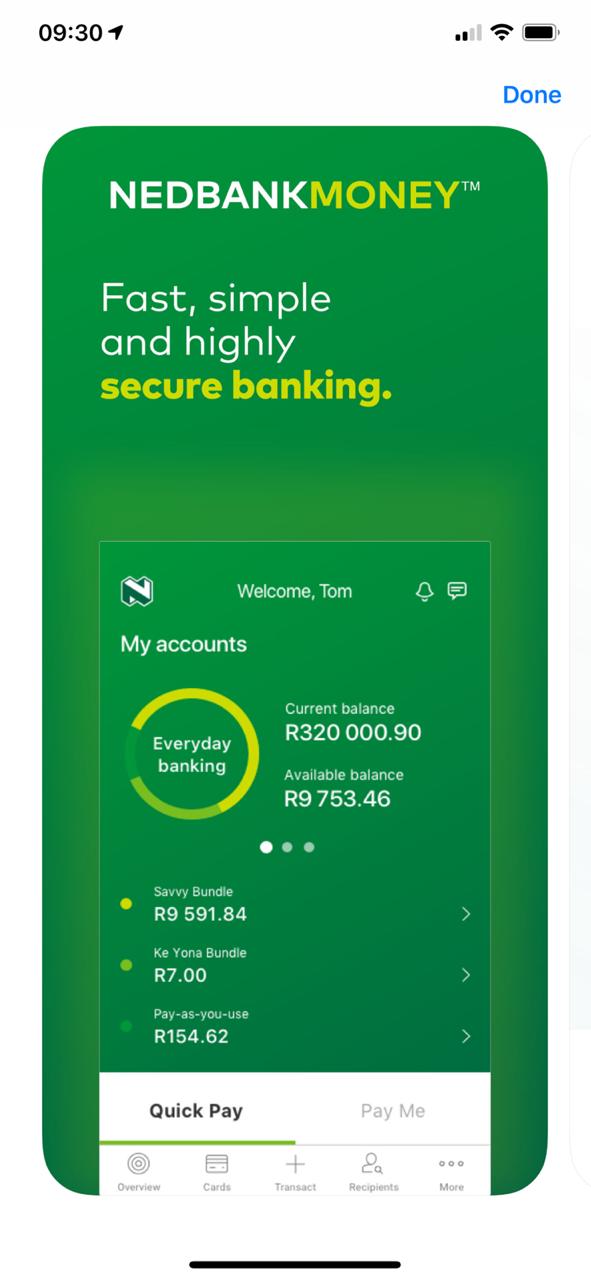

NEDBANK Lesotho this week launched its improved Nedbank Money App meant to improve clients’ banking experience.

The application, which was unveiled by Nedbank Lesotho’s managing director Nkau Matete in Maseru this week, comes with 19 new functions, which enable clients to do quick and easy banking while also managing their accounts from anywhere and at any time.

Some of the highlights of the new application include the ability to freeze usage of a lost or misplaced card; the ability to set up recurring payments; loan calculator for vehicle finance, personal and home loans; nearest ATM and branch locator; and a touch ID login function among others.

Some of the highlights of the new application include the ability to freeze usage of a lost or misplaced card; the ability to set up recurring payments; loan calculator for vehicle finance, personal and home loans; nearest ATM and branch locator; and a touch ID login function among others.

These are over and above the basic service features of making payments, money transfers and prepaid services.

Mr Matete said the application is just another way in which Nedbank is fast-tracking innovation to deliver quick, safe and easy banking to its clients.

He added that the new innovations are needs based for the clients to manage and control their money better instead of worrying about their banking.

“The intuitive and personalised app allows clients to see how much money they have and how much they owe using a fresh graphical dashboard where they can manage their money like never before,” Mr Matete said.

He said the application, which functions on smartphone devices with internet access, incorporates smartphone functions such as finger print recognition to improve the banking experience.

More features are scheduled to be added onto the App as time progresses for better client experience. Users of the old application will be able to continue operating the app for the next two months while preparing to migrate to the new application.

To access the application, clients can visit their nearest Nedbank branch to register and then download the App from Google Play Store or iStore.

Meanwhile, in his recent visit to Lesotho Nedbank Group’s chief executive officer, Mark Brown, indicated that the group is investing more resources into financial technology systems to improve their customers’ banking experience. He said the group spends about M2 billion on its digital systems annually to enhance client satisfaction.